The Best Guide To Property By Helander Llc

The Best Guide To Property By Helander Llc

Blog Article

Excitement About Property By Helander Llc

Table of ContentsProperty By Helander Llc - The FactsNot known Factual Statements About Property By Helander Llc The Ultimate Guide To Property By Helander LlcThe smart Trick of Property By Helander Llc That Nobody is Talking AboutThe Best Strategy To Use For Property By Helander LlcFacts About Property By Helander Llc Revealed

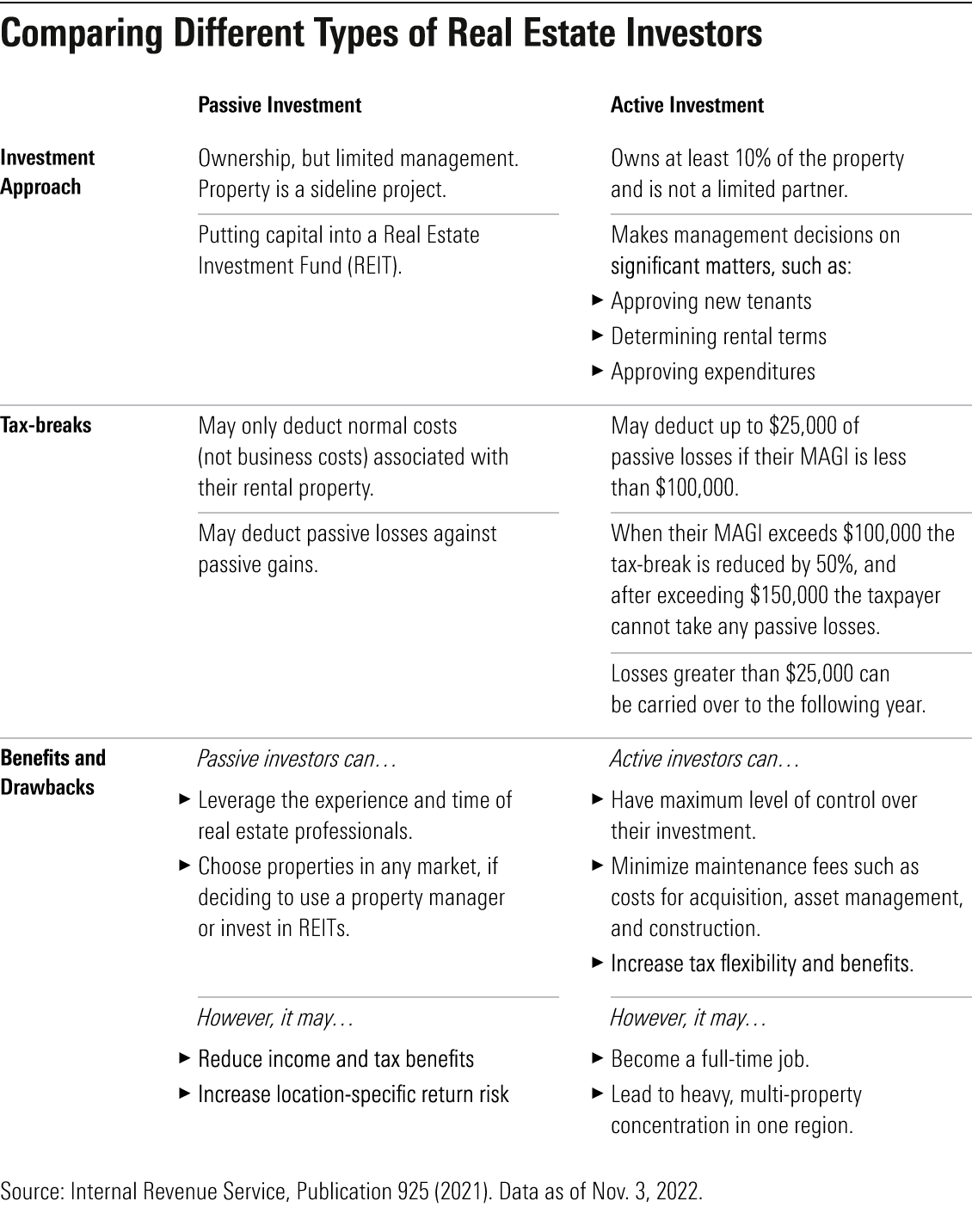

The benefits of investing in real estate are countless. Right here's what you require to recognize regarding genuine estate benefits and why genuine estate is thought about a great investment.The benefits of spending in real estate consist of passive earnings, steady money circulation, tax advantages, diversification, and leverage. Actual estate financial investment counts on (REITs) provide a means to invest in actual estate without having to possess, run, or financing buildings.

In most cases, capital just reinforces over time as you pay down your mortgageand develop your equity. Actual estate investors can make the most of countless tax breaks and deductions that can conserve cash at tax time. As a whole, you can subtract the affordable prices of owning, operating, and handling a residential property.

Property By Helander Llc Can Be Fun For Anyone

Realty values tend to enhance with time, and with a good investment, you can turn a profit when it's time to market. Rents also tend to climb in time, which can result in higher money circulation. This graph from the Reserve bank of St. Louis reveals average home prices in the U.S

The areas shaded in grey show U.S. recessions. Average Sales Rate of Homes Cost the United States. As you pay down a residential or commercial property home loan, you construct equityan asset that belongs to your total assets. And as you develop equity, you have the leverage to acquire even more residential properties and raise cash money flow and wide range much more.

Due to the fact that realty is a tangible asset and one that can act as collateral, financing is easily offered. Actual estate returns differ, relying on factors such as place, possession course, and monitoring. Still, a number that many financiers aim for is to beat the average returns of the S&P 500what lots of people refer to when they state, "the marketplace." The rising cost of living hedging ability of actual estate originates from the favorable relationship between GDP development and the need for actual estate.

The Facts About Property By Helander Llc Uncovered

This, in turn, equates right into higher funding worths. Real estate often tends to keep the acquiring power of resources by passing some of the inflationary pressure on to renters and by integrating some of the inflationary pressure in the type of resources admiration - sandpoint idaho realtor.

Indirect genuine estate spending involves no direct possession of a home or residential properties. There are several ways that having genuine estate can shield versus inflation.

Residential or commercial properties financed with a fixed-rate car loan will see the loved one amount of the month-to-month mortgage payments fall over time-- for circumstances $1,000 a month as a fixed payment will come to be less difficult as rising cost of living wears down the acquiring power of that $1,000. https://www.huntingnet.com/forum/members/pbhelanderllc.html. Typically, a key house is ruled out to be an actual estate financial investment because it is made use of as one's home

The Ultimate Guide To Property By Helander Llc

Even with the aid of a broker, it can take a few weeks of work simply to discover the best counterparty. Still, real estate is an unique possession course that's simple to comprehend and can boost the risk-and-return account of a financier's profile. On its own, actual estate uses cash money flow, tax obligation breaks, equity building, competitive risk-adjusted returns, and a bush versus inflation.

Purchasing realty can be an unbelievably satisfying and profitable venture, however if you're like a great deal of brand-new financiers, you may be questioning WHY you should be purchasing realty and what advantages it brings over various other investment chances. In addition to all the incredible benefits that come along with investing in genuine estate, there are some drawbacks you require to take into consideration.

Our Property By Helander Llc Diaries

If you're searching for a method to get right into the realty market without having to invest numerous countless dollars, check out our homes. At BuyProperly, we utilize a fractional possession version that enables capitalists to begin with as low as $2500. One more significant advantage of actual estate investing is the capacity to make a high return from acquiring, renovating, and reselling (a.k.a.

Some Known Incorrect Statements About Property By Helander Llc

As an example, if you are charging $2,000 rent per month and you sustained $1,500 in tax-deductible expenditures each month, you will just be paying tax on that $500 revenue monthly. That's a large distinction from paying tax obligations on $2,000 monthly. The revenue that you make on your rental for the year is taken into consideration rental revenue and will certainly be exhausted appropriately

Report this page